Understanding Debt: Robert Kiyosaki’s Insights for Millennials

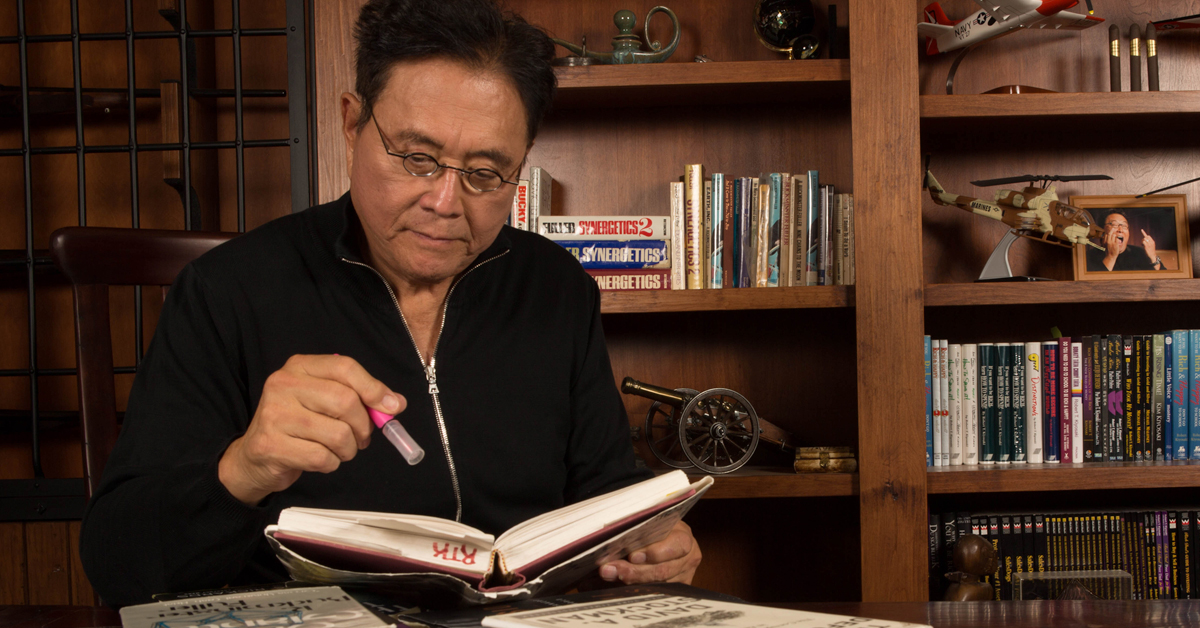

In a recent episode of “Millennial Money,” Robert Kiyosaki sat down with Alexandra to discuss a topic that resonates deeply with many young adults: debt. This conversation is part of a series aimed at providing millennials with essential financial knowledge.

The Perception of Debt

Kiyosaki opened the discussion by asking Alexandra what comes to mind when people mention getting out of debt. She responded, “When people say get out of debt, I think about credit card debt, student loan debt, and all that negative debt that people use for shopping and personal things.”

When asked about her perception of debt, Alexandra admitted, “I have a very negative idea or connotation towards debt, and that’s because that’s what we were taught in the traditional education system.” However, she acknowledged that her experience working with Kiyosaki and attending his seminars has changed her perspective. “I understand that debt can be powerful and can be used in a good way to generate money,” she said.

The Dual Nature of Debt

Kiyosaki emphasized that debt is often viewed negatively, especially by financial gurus who advocate for living completely debt-free. “There are many people who say cut up your credit cards, and that’s good advice for certain types of people,” he noted. However, he pointed out that credit cards can be useful for various transactions, such as checking into hotels or renting cars.

The key takeaway from their discussion was the distinction between good debt and bad debt. Kiyosaki classified student loan debt as bad debt, primarily because it is often burdensome and cannot be easily discharged through bankruptcy. “If you’re a student, you shouldn’t take on student loan debt unless you are 100% committed to graduating,” he advised.

The Importance of Career Choices

Kiyosaki shared anecdotes about friends who graduated with significant student loan debt but were able to pay it off quickly due to their high-paying medical careers. In contrast, he highlighted the plight of students who change majors multiple times without a clear career path. “I have a friend who has changed her major three times and is now stuck in a nursing career she doesn’t even like,” Alexandra added.

Kiyosaki reflected on his own experiences, noting that while he was earning a modest salary compared to his peers, he was determined to follow his own path rather than join a labor union. “I didn’t want to be a union member; it was just principle for me,” he explained.

Navigating the Modern Job Market

The conversation shifted to the current job market, where many high-paying jobs are becoming scarce due to advancements in technology and artificial intelligence. Kiyosaki emphasized the importance of understanding the implications of student loan debt before committing to it. “You need to ask yourself: Are you going to graduate? And what are you going to graduate as?” he urged.

The Flaws of Traditional Education

Alexandra expressed her frustration with traditional education, stating, “The reality is that traditional education is obsolete. What mattered back then does not apply to how you’re going to run your business now.” Kiyosaki agreed, noting that many educators lack real-world experience in the subjects they teach.

He encouraged young people to seek practical knowledge and skills that will serve them in their careers. “If I were in your position, I would focus on finding my way in life and not be afraid to explore different paths,” he advised.

Understanding Good Debt vs. Bad Debt

Kiyosaki reiterated the importance of distinguishing between good debt and bad debt. He explained that a house, for example, is often considered a liability rather than an asset because it incurs ongoing expenses. “Even if you have no debt on your house, you still have taxes, repairs, and upkeep,” he noted.

In contrast, Kiyosaki shared his experience of purchasing rental properties that generate positive cash flow. “When I bought my first property, it put $25 in my pocket every month. That was good debt,” he explained. He emphasized that the key to understanding debt lies in cash flow: “If the cash is flowing into your pocket, it’s an asset; if it’s flowing out, it’s a liability.”

The Role of Financial Education

Kiyosaki highlighted the lack of practical financial education in traditional schooling. “Most accounting classes don’t teach you about cash flow,” he lamented. Alexandra agreed, noting that her own accounting classes failed to provide real-world applications.

Kiyosaki concluded the discussion by encouraging millennials to embrace debt wisely. “Don’t be afraid of debt if you know how to use it,” he advised. “Good debt puts money in your pocket, while bad debt takes money out of your pocket.”

Final Thoughts

As the conversation wrapped up, Kiyosaki and Alexandra emphasized the importance of understanding the nature of debt and its impact on financial well-being. For millennials navigating a complex financial landscape, the insights shared in this episode serve as a valuable guide to making informed decisions about debt and financial management.